Europe aims to lead in AI and energy security: How does natural gas fit into this vision?

AI and Natural Gas: Intermezzo

Elon Musk’s AI cluster in Memphis relies on natural gas turbines to power a 150 MW AI facility, soon expanding to 1.5 GW. And that is just one US AI data centre in the making. If Europe, wishing to lead in AI, would match the US’s 500 hyperscale data centres and running just 20% on natural gas, it would require 130 bcma, necessitating secure gas supplies and CCUS integration to keep the course on decarbonisation, and provide firm and secure power needed for European AI. Achieving this requires a fresh perspective on energy security, particularly the role of gas in ensuring stability amidst AI expansion. To understand this, we must first define what energy security means in today's context.

Definition of Energy Security: The example of gas

Gone are the days when energy security was a given, and did not need defining; gas flows were highly predictable, with a main flow from east to west (of Russian gas), based on longer-term contracts into stable low-price markets; having a surplus of energy availability. Energy security, as implied in the article, is the ability to ensure a stable, reliable, and adaptable energy supply in an increasingly volatile and uncertain global market. It requires a multi-energy vector model that integrates natural gas, future fuels (biomethane, hydrogen, synthetic derivatives, CO₂ networks), and electricity, while also addressing infrastructure, supply diversification, and system integration.

However, ensuring energy security is becoming increasingly complex due to rapid geopolitical shifts and evolving market conditions. The once-stable gas landscape is now marked by volatility, requiring Europe to rethink its approach.

The Changing Energy Landscape

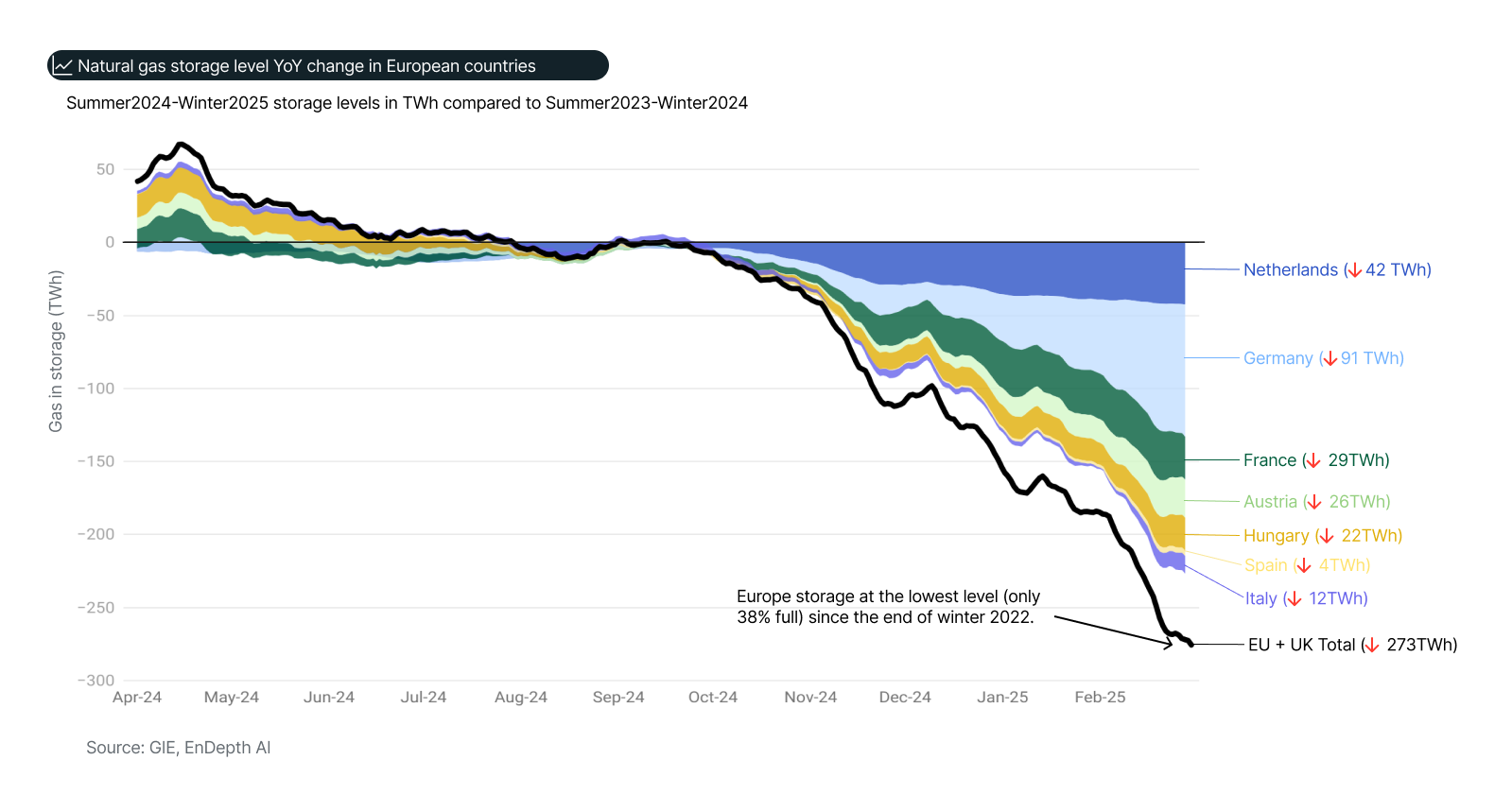

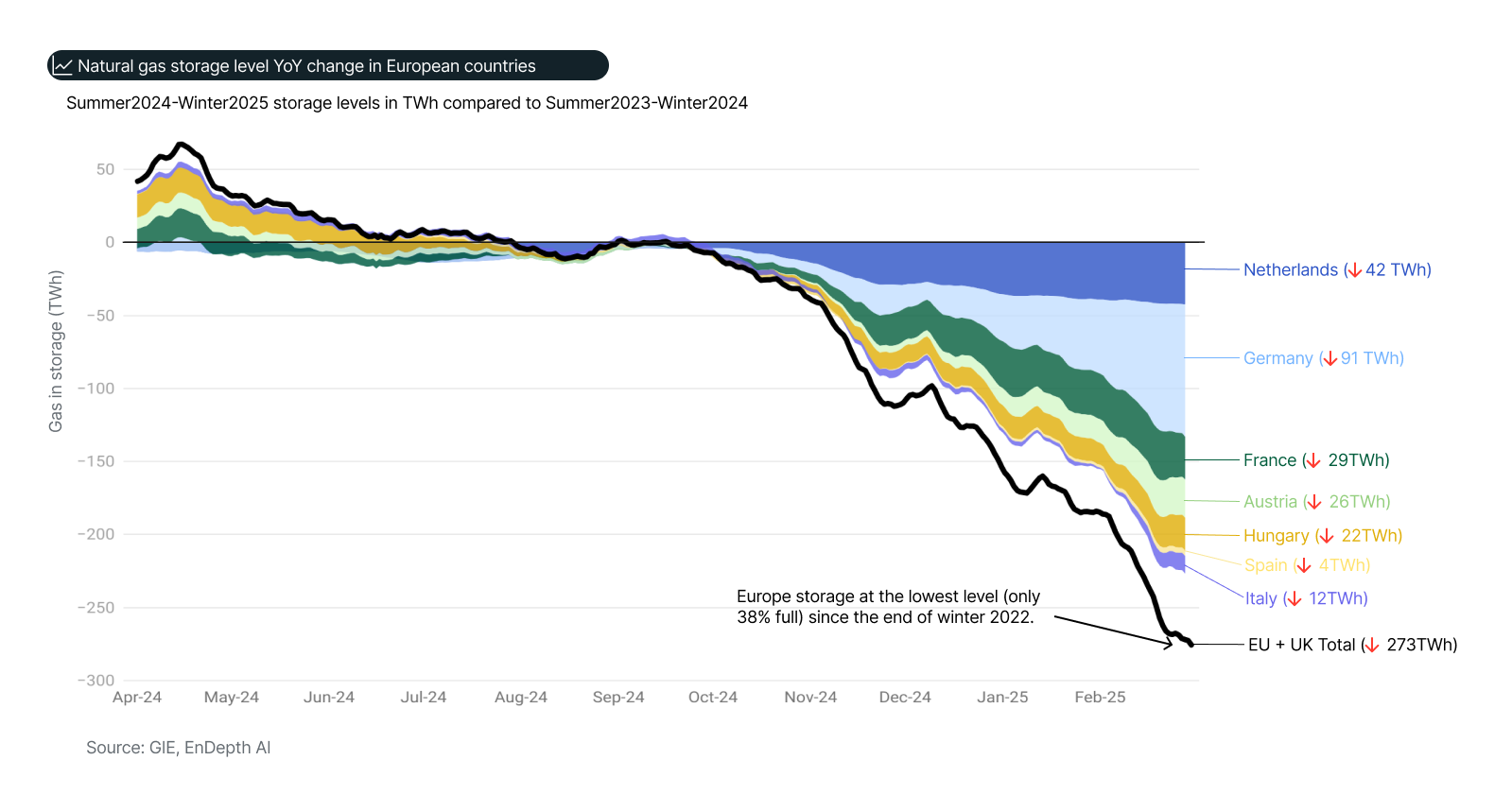

Gas flows and spreads were once predictable, but today’s markets are fragmented and volatile, in view of geopolitics and uncertainty being the new normal. The development of spreads, once underpinning the gas storage investments, is illustrative of the new uncertainty:

Europe must rethink its security framework for gas, balancing regulation with market adaptability. While it once had strong gas supply security with imports from Russia, Norway, and Africa, shifting geopolitical dynamics and decarbonisation policies have introduced new challenges. US supplies (of LNG) can be part of the solution, or as geopolitical tension increases, be yet another risk, increasing prices and reducing security.

Gas Infrastructure: Available but Underutilised

Europe has extensive gas pipelines, LNG terminals, and underground storage, but full utilisation remains an issue:

- Storage Utilisation: Despite prioritising gas storage post-Ukraine war, utilisation remains inconsistent, raising costs and uncertainty for market players.

- LNG Dependence: Russian gas was “cheap”, and in new times Europe’s policy shift increased reliance on costly and volatile LNG markets to “flow” through infrastructure.

- Infrastructure Use: Regulations (filling targets) now aim to ensure commercial players maximise infrastructure use, improving supply stability and pricing – results are yet be harvested – and as we observe storage filling (as indication of energy security) – is yet to become stable; commercial players appear hesitant to fully utilise gas storage despite EU regulations, and large short term profits are cashed in:

While efforts are underway to enhance infrastructure utilisation, significant gaps remain. To build a truly resilient energy system, Europe must not only improve gas security but also expand its focus to a broader, multi-energy strategy.

Future-Proofing Energy Security: A multi-energy vector model

As we can see from the above discussion – energy security for gas is not being delivered (yet) at full. So, what can be done to give natural gas a chance to be seen as a secure fuel for Europe?

Energy security must evolve beyond natural gas by integrating biomethane, hydrogen, and CO₂ networks, along with coordinated measures for gas, future fuels, and power grids:

- Minimise dependence - Supplier Limits: To prevent dependency, no supplier should control more than 10 to 20% of Europe’s gas market nor of any of the future fuels such as biomethane or hydrogen.

- Create stock - Hydrogen Storage Targets: Similar to CO₂ injection goals, hydrogen storage must be mandated to avoid costly delays, and lack of sufficient local storage. Hydrogen storage can mitigate renewable energy curtailment and stabilise supply.

- Create access to alternatives - Sector Coupling: Access across energy vectors can help energy security – electricity can and should be often the new alternative for gas (e.g. in households with heat pumps); vice versa - balancing renewable energy e.g. would be helped with molecule-based storage solutions, yet policy focus is lacking so far on system integration. Congested electricity transmission networks, slow electrification, while gas infrastructure remains reliable – from discussions we observe system integration between power and gas remains weak, albeit tools like digital twins can offer ways for stronger collaboration.

Addressing the described solution pathways requires a coordinated approach that integrates existing gas assets with future fuels and smarter grid solutions.

Conclusion: A pragmatic approach

This brings us to the final step—how Europe can implement a pragmatic strategy to secure its energy future. To secure energy while decarbonising, Europe must leverage and adapt existing gas infrastructure to play a balancing tool for an integrated energy system. Without a forward-looking strategy, energy security could undermine Europe’s climate and AI ambitions. The time for action is now.

This article was done as example of collaboration between Frances Feng of Endepth.AI and human authors (Rakhou Associates & Torben Brabo Consulting) with senior gas experience. We made use of AI-driven research approach that begins with a defined thesis or question, which is then analyzed by proprietary AI systems trained on energy and climate topics. These systems collect and categorize publicly available data, organizing it into structured databases for flexible analysis (tables, timelines, maps, etc.). Unlike standard AI models, Endepth AI' custom-built system enhances data structuring and categorization, allowing Erik Rakhou and Torben Brabo to interpret and refine AI-generated insights. This method provides a faster and significantly cheaper alternative (5-15x lower cost) to traditional consultancy firms, offering a first test or second opinion within 2-3 weeks instead of 4-12 weeks.

For more info on authors: www.endepth.ai ; www.rakhou.com and Torben Brabo | LinkedIn