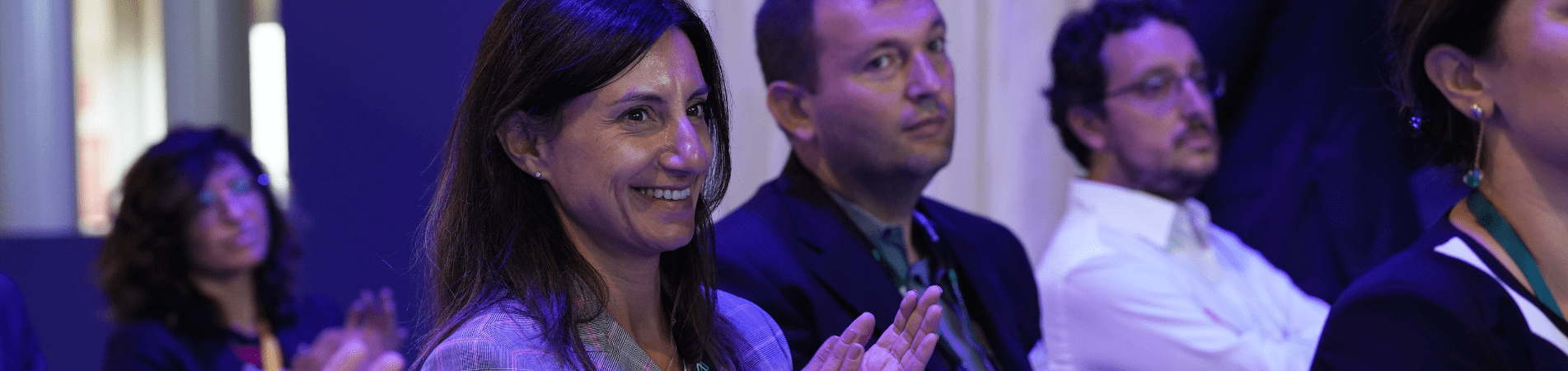

Experts from across the value chain offered broad and generally optimistic perspectives on a sector that has a growing project pipeline but requires more clear global policy.

While there is growing confidence in carbon capture, utilization, and storage (CCUS), the industry must still muster investor enthusiasm while not running too fast. These were among key messages to emerge from a Climatetech & AI Strategic panel session that also examined the challenges and possible policy hurdles the sector faces.

In a broad conversation titled Building a Commercial Market for CCUS, panelists from across the value chain called for certainty alongside patience and partnerships in evolving the industry as it unlocks large-scale commercial growth and adoption. Panelists touched on how their businesses are impacting the CCUS space in different ways, with a consensus on how collaboration and “the right partnerships” can progress the industry with a 1-gigaton goal in mind.

The IEA estimates that US$3.5 trillion per year is needed to capture or offset emissions from existing oil and gas output, and operational capacity of CCUS needs to increase 100-fold. That means ramping up from where the sector is now.

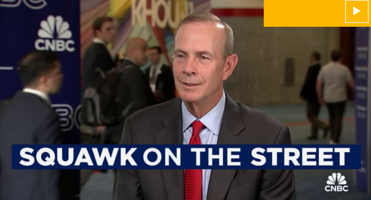

Gordon Huddleston, President & Partner of Aethon Energy, said it was right to pursue the “low-hanging fruit” in terms of projects, and then “the cake” could be built on top of that, but he cautioned against moving too quickly.

“Nothing moves until it does, and then it flows really well,” he told the Climatetech & AI Theater. “The things that we’re talking about here are lots of little hurdles that we have to get right, to make sure the regulators are happy and comfortable, that there are no big bumps in the road that throw public opinion off, that there are no big losses… no big safety incidents.

“These are things that we have to get right and share; that’s what’s going to move us forward.”

The sentiment was echoed by others, including Chris Powers, VP - Carbon Capture, Utilization & Storage (CCUS) & Emerging, who also stressed the need for companies such as his to realize they cannot achieve carbon capture ambitions alone.

“Unconventional ideas and disciplined execution unleash the impossible. So the gigaton target feels impossible to us, but we’ve got to start making progress,” he said.

“The unconventional ideas are going to help us on this pathway, but if you don’t do these projects correctly, and these first foundational projects aren’t done with excellence, then we’re not going to have the societal license to operate and improve these businesses over time.”

Jonathan Minnitt, VP of Business Development, Aker Solutions, urged the industry to “get on with it as much as we can… push it as hard as we can,” but he also highlighted how 50% of the world was going to the polls in 2024, meaning “massive delays” to projects.

These and other aspects could dampen a sector that requires clear global policy, investor confidence, as well as regulation to earn public trust in CCUS.

All that said, moderator Poh Boon Ung, GM - Business Development & Engagement at the Global CCS Institute, highlighted how 200 project permits were now in place.

Aniruddha Sharma, CEO & Chair of Carbon Clean, raised the issue of supplying hardware to match capacity, such as the areas in which his company works.

“The race now is who can actually get the technology in position that you can start setting up gigafactories,” he said. “There is a lot of logic in optimizing the cost on the production line versus trying to go and set up a bespoke project at every single site.”

Minnitt added that proving technology was “really going to help bankability across the board.” But he also cautioned: “There is a lot of new technology, and sometimes I think projects go for too much new technology all at once, and that makes it very difficult to invest.