The green hydrogen sector in the United States is facing significant uncertainty, as part of an evolving regulatory landscape. In particular, the proposed Inflation Reduction Act (IRA) Section 45V Clean Hydrogen Production Tax Credit presents opportunities — but also serious challenges for market participants.

As developers negotiate long-term commercial deals with both local and global off-takers, understanding the impact of this regulation on project design and commercial conditions is now crucial.

BCG, leveraging a global team of hydrogen experts, proprietary modeling tools, and market-leading benchmarks, is ideally placed to support clients with commercialization journeys and strategies — here’s how.

Firstly, the 45V regulation introduces three critical elements that green hydrogen production must display in order to qualify for subsidies. These are:

- Incrementality: Only new or recently upgraded renewable energy facilities can power hydrogen production.

- Temporal matching: Annual matching of power grid energy consumption to renewable generation is allowed until 2028, shifting to hourly thereafter.

- Deliverability: Renewable energy must be sourced from the same region as hydrogen production.

These rules have sparked a significant amount of attention and debate. A real-world case study from BCG can shed light on how these elements interact, and how best we can approach understanding them.

Optimizing a US Hydrogen Project and Analyzing Regulatory Impact

To take an example, we examined a hydrogen project in the US that aimed to optimize cost efficiency under the 45V regulations. It included renewable energy sources (solar and wind), grid connections, energy storage, and electrolyzers. Off-take contract conditions required at least 1t of green hydrogen per hour for continuous operations.

The project incorporated new solar and wind farms to comply with incrementality requirements, and capital expenditure on these facilities significantly affected the project's financial planning and investment strategies.

With regard to temporal matching, the shift to hourly matching post-2028 posed a significant challenge, potentially increasing production costs by 10-25% (excluding the tax credit impact). This necessitated advanced energy management to optimize hourly energy usage.

Lastly, deliverability issues: Ensuring that renewable energy sources and hydrogen production are located within the same region simplifies regulatory adherence. But it also requires careful site selection to maximize the joint potential of renewable energy and grid connectivity.

BCG X Capital Project Optimizer

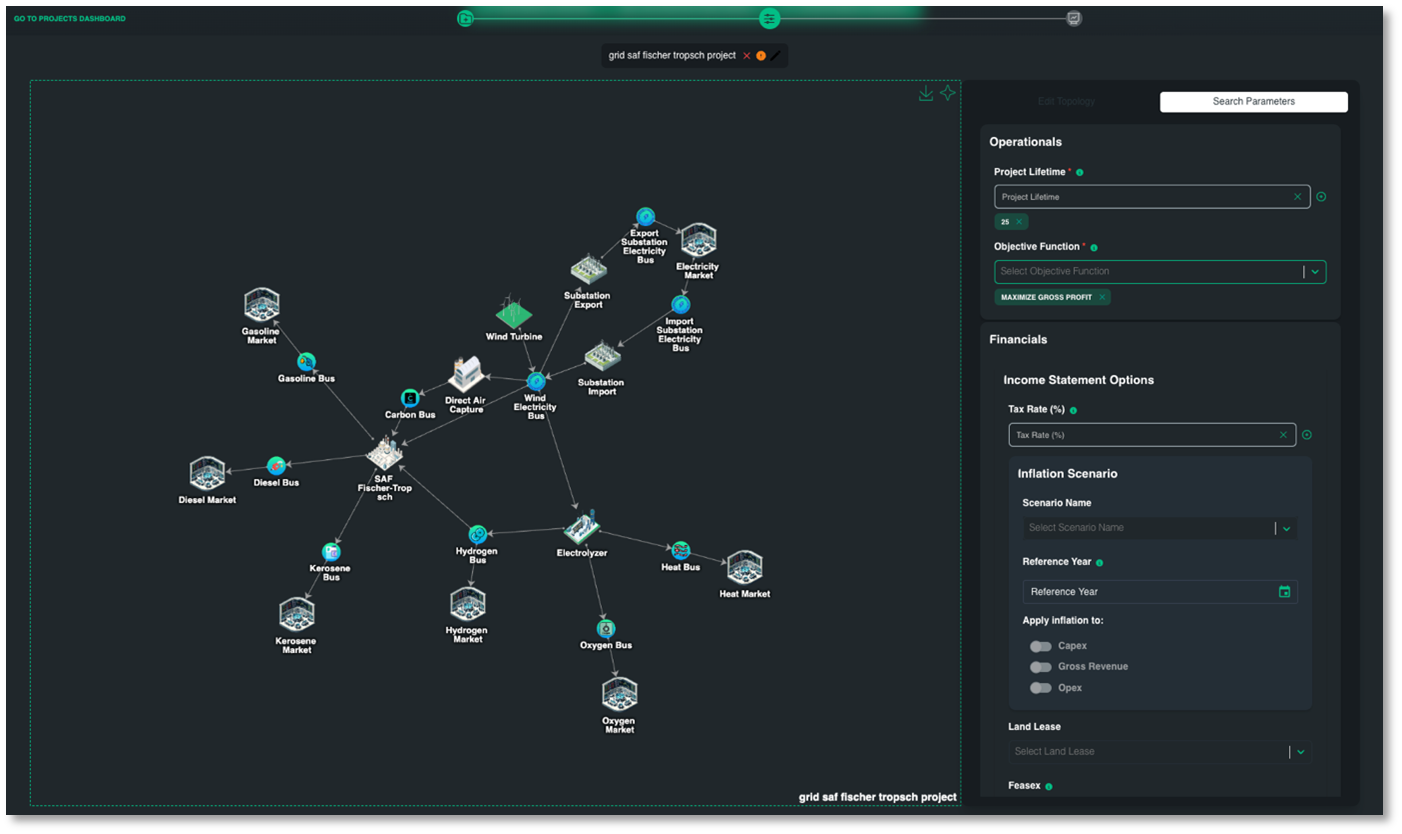

To help with these types of contract negotiations, the BCG X Capital Project Optimizer unifies engineering design, commercial contracting, and financial models.

The system explores and optimizes a business case as it applies to multiple market prices and regulatory scenarios, helping to identify the best asset combinations of storage, renewables, electrolysis, and grid connections, along with optimal commercial contracts. This ensures the most efficient and profitable project set-up under shifting regulatory conditions.

Figure 1: Integrated Power-to-X system set-up in BCG X's optimizer software

Key Strategic Recommendations

Additionally, BCG recommends a set of strategic principles that can further assist in assessing and optimizing the opportunities arising:

- Model realistic operations: It’s essential to take into account renewable intermittency, limited grid connection, minimum operating rates, ramp rates and shutdowns in order to evaluate a business case effectively.

- Maximize flexibility allowance across the value chain first: Contract conditions should be set up to model the full value chain of the project (off-take consumers, for example producers of DRI or ammonia, may enjoy additional flexibility here, which can dramatically improve the business case.

- Unify team views in single model: Engineering, legal, business and financial teams need to operate together on a single model to obtain valuable business cases.

Conclusion

Optimizing hydrogen projects under IRA 45V regulations will require a careful balance of compliance with cost efficiency. AI optimization models, coupled with careful strategic planning, can help ensure that business cases are sustainable as well as profitable. Finally, making proper use of unified models can significantly facilitate negotiations, by aligning parties across issues of financial and operational viability.

Authors: Malo Grisard and Krzysztof Postek

Supporting Authors: Mogens Holm, Stevan Jovanovic and Martin Pocquet